Insurance is a highly competitive industry, and agents work hard to earn every customer. Every lead counts, and it’s important to carefully nurture each one efficiently and relevantly. Agents should be following a strategic sales funnel to maximize conversions.

Keep reading to learn more about the sales funnel for insurance agents and how to follow up with leads more strategically than ever.

Sales Funnel for Insurance Agents

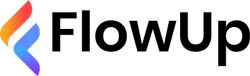

To effectively nurture and convert prospects into leads and customers, it’s important to approach your communications with the sales funnel in mind. The sales funnel is generally divided into three groups: top of the funnel, middle of the funnel, and bottom of the funnel.

The top of the funnel audience is in the awareness stage and is just now becoming aware of your brand and offering.

The middle of the funnel is the consideration stage, where a product gets recognition as a valid option to buy among various competitive options. Here, prospects consider the product within their decision pallet.

And lastly, the bottom of the funnel is the decision stage. This is the time when leads have already weighed the pros and cons, benefits and risks, and need to make a final decision.

Tailoring communication for Every Stage of the Insurance Sales Funnel

Audiences at each stage of the sales funnel are different, with distinct questions, motivations, desires, objections, and doubts. That’s why it’s important to speak to each segment of your audience in a way that resonates with them in relation to their position in the funnel and sales process.

Think about it: if someone wanted to know what flood insurance covers, would it make sense to respond with a link to sign up for a policy?

On the other hand, if someone wanted to know which company has the best insurance rates, would it make sense to link to a blog post explaining why it’s important to have insurance?

No!

Messaging must be tailored and specific to where the audience is in the funnel.

As a general rule of thumb, this is the kind of content to share with each stage of the funnel:

- Top: Educational and informative

- Middle: Competitive advantages and benefits of your company

- Bottom: All concerns and objections addressed; final discount or incentive offered

Streamline your Communication with Automated Lead Follow-ups

top-of-the-funnel awareness can be achieved through several different tactics, like writing blogs, putting up billboards, advertising, and other traditional and digital marketing techniques. These strategies can be utilized to generate inbound activities, like calls to your business, visits to your website, subscriptions to your emails, requests for policy quotes, and more.

However, what happens in the next two stages of the funnel is crucial.

Now that you have new leads and prospects who are officially in the middle of your sales funnel, what can you do to keep them engaged and ultimately convert?

The key is attentive, thorough, and well-timed nurturing and follow-ups.

Following up, nurturing, and engaging insurance leads is a lot of work that has historically required endless manual effort. It’s tricky to remember exactly when to follow up with which leads are at the appropriate stage in the sales funnel. On top of that, timing is a challenge as well. You don’t want to miss a check-in — otherwise, a competitor will step in.

Enter automated lead follow-ups.

How Follow-up Automation can help you set up an Organized Sales Funnel for Insurance Business?

Follow-up automation takes the hassle out of manual, individual follow-ups. With an automated lead follow-ups system, all you have to do is create a follow-up campaign strategy with messaging tailored to each stage of the funnel, and the workflow you create is set in motion. This approach helps insurance agents streamline their business, work more efficiently, and ensure they never miss out on valuable communications with their leads.

Automating the follow-up process means agents can close more leads with less work, allowing them to focus their time and attention on other mission-critical activities.

How does your search for Follow-up Automation end with FlowUp?

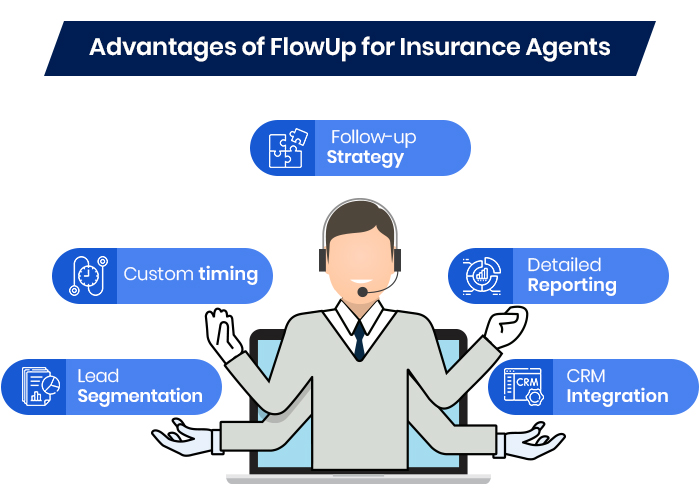

FlowUp does exactly that and more. Insurance agents can automate their follow-ups across voice and text channels while segmenting and filtering leads so they always send the right message to the right person.

With FlowUp, Insurance agents can experience the simplified automated lead follow-up system

- Tailor-made Follow-up Strategy: Create a unique workflow customized to the needs of your own individual business.

- Custom timing between touchpoints: Schedule your communications to occur at sweet-spot intervals — not too early, not too late.

- CRM Integration: FlowUp seamlessly integrates with your existing CRM so important information is shared between both platforms.

- Lead Segmentation: Create custom lists to personalize your communications based on the lead’s status in your workflow.

- Detailed Reporting: Access real-time data to discover what works and what doesn’t, so you can tighten your messaging.

Imagine how easy insurance sales can be when FlowUp handles the follow-ups for you! Click here to see FlowUp in motion, or Book a Demo to get started Today..!!